Some Ideas on Paul B Insurance You Should Know

Wiki Article

Paul B Insurance for Dummies

Let's suppose you pass away an untimely death at a time when you still have several turning points to attain like youngsters's education and learning, their marriage, a retired life corpus for your partner etc. There is a debt as a housing funding. Your unfortunate demise can put your household in a hand to mouth circumstance.

Despite how hard you try to make your life much better, an unforeseen event can completely turn things inverted, leaving you literally, emotionally as well as economically stressed. Having sufficient insurance coverage assists in the sense that at the very least you don't need to believe about cash throughout such a tough time, and also can concentrate on recovery.

Having wellness insurance policy in this case, saves you the concerns and stress and anxiety of setting up cash. With insurance policy in place, any financial stress and anxiety will certainly be taken treatment of, and you can focus on your recovery.

Some Known Facts About Paul B Insurance.

With Insurance policy compensating a large part of the losses businesses and households can get better rather conveniently. Insurer pool a big quantity of cash. Part of this money can be invested to sustain investment tasks by the government. Because of the security worries insurance firms just purchase Gilts or federal government securities.

Within this time they will certainly accumulate a huge amount of wide range, which returns to the investor if they survive. If not, the riches goes to their household. Insurance policy is a crucial financial device that aids in taking care of the unanticipated expenses smoothly without much inconvenience.

There are generally 2 kinds of insurance policy as well as let us understand exactly how either is relevant to you: Like any type of responsible person, you would certainly have planned for a comfy life basis your income as well as job estimate. They also provide a life cover to the guaranteed. Term life insurance coverage is the pure kind of life insurance policy.

If you have a long time to retire, a deferred annuity offers you time to spend throughout the years and also develop a corpus. You will certainly obtain income streams called "annuities" till completion of your life. Non-life insurance is likewise described as basic insurance coverage as well as covers any insurance policy that is outside the province of life insurance policy.

When it comes to non-life insurance plan, factors such as the age of the property and insurance deductible will likewise influence your selection of insurance policy plan. Permanently insurance policy strategies, your age and also wellness will certainly impact the premium cost of the strategy. If you have a vehicle, third-party insurance policy coverage is compulsory prior to you can drive it when driving.

moved here

Rumored Buzz on Paul B Insurance

Disclaimer: This article is issued in the general public passion and also implied for basic info purposes just. Visitors are advised to exercise their care and also not to count on the contents of the short article as conclusive in nature. Readers ought to research additional or seek advice from an expert hereof.

Insurance policy is a legal arrangement in between an insurance policy company (insurance provider) and an individual (insured). In this case, the insurance coverage company guarantees to compensate the insured for any type of losses sustained due to the protected contingency happening. The backup is the event that causes a loss. It could be the insurance policy holder's fatality or the residential property being damaged or destroyed.

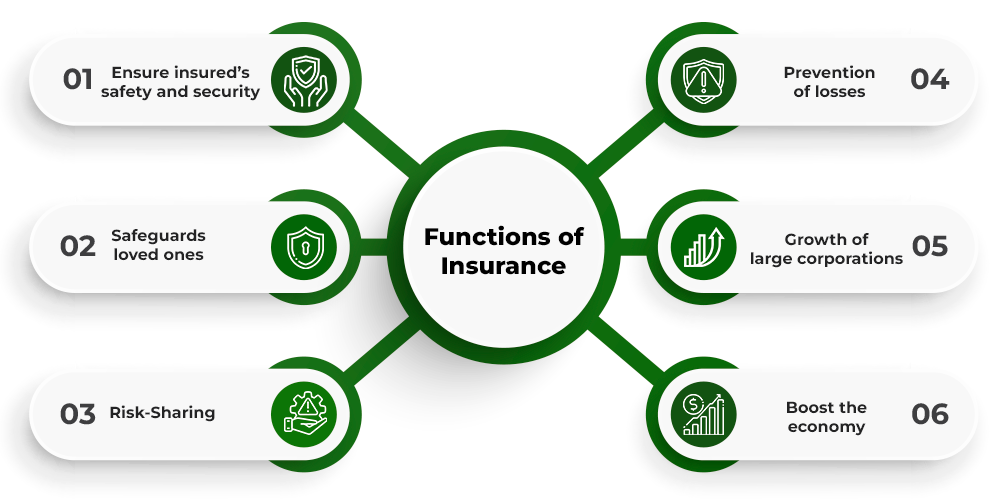

The primary functions of Insurance coverage are: The vital function of insurance policy is to secure versus the possibility of loss. The moment and also quantity of loss are uncertain, and also if a risk occurs, the person will certainly sustain a loss if they do not have insurance. Insurance policy guarantees that a loss will certainly be paid and also consequently protects the insured from experiencing.

See This Report about Paul B Insurance

The treatment of figuring out costs prices is additionally based on the policy's dangers. Insurance provides repayment assurance in the event of a loss. Much better planning and management can help to reduce the danger of loss (Paul B Insurance).

There are a number of second features of Insurance coverage. These are as complies with: When you have insurance, you have actually ensured money to pay for the treatment as you get correct financial assistance. This is among the key additional functions of insurance where the public is shielded from conditions or crashes.

The feature of insurance is to soothe the stress and anxiety as well as distress connected with fatality and also residential or commercial property damage. An individual can devote their body and soul to far better achievement in life. Insurance policy offers a reward to strive to much better individuals by securing society against large losses of damage, devastation, and fatality.

Excitement About Paul B Insurance

There are a number of roles and also significance of insurance coverage. A few of these have actually been offered below: Insurance policy money is spent in numerous initiatives like water, power, and also highways, adding to the nation's overall economic success. Instead than concentrating on a bachelor or organisation, the danger impacts different individuals and also organisations.

It motivates threat control action because it is based upon a threat transfer system. Insurance plan can be used as security for credit history. When it involves a house financing, having insurance policy coverage can make acquiring the car loan from the lender much easier. Paying taxes is one of the significant obligations of all residents.

25,000 Area 80D Individuals as well as their family members plus parents (Age much less than 60 years) Amount to Rs. 50,000 (25,000+ 25,000) Section 80D People and their family plus moms and dads (Age greater than 60 years) Overall Up to Rs. 75,000 (25,000 +50,000) Section 80D People as well as their family members(Anyone above 60 years old) plus moms and dads (Age greater than 60 years) Overall Up to Rs.

check this

Fascination About Paul B Insurance

All kinds of life insurance coverage policies are available for tax obligation exception under the Income Tax Obligation Act. Paul B Insurance. The benefit is obtained on the life insurance coverage plan, whole life insurance policy strategies, endowment strategies, money-back policies, term insurance policy, and also Unit Linked Insurance Program.

This provision additionally enables an optimum reduction of 1. 5 lakhs. Everyone needs to take insurance coverage for their well-being. You can pick from the different kinds of insurance as per your requirement. It is advised to have a health and wellness or life insurance policy because they verify valuable in challenging times.

go to the websiteInsurance coverage assists in relocating of threat of loss from the insured to the insurance firm. The fundamental principle of insurance is to spread out threat among a large number of individuals.

Report this wiki page